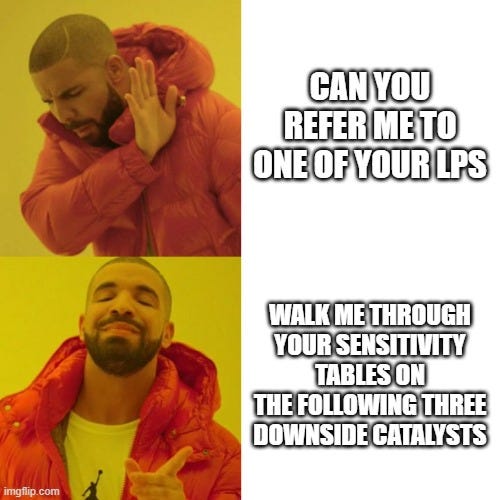

Bad LP Diligence Questions

What questions LPs should NOT ask

Happy Thursday!

I’ve written many articles on diligence over the years, which I’ll include below with the most popular articles in bold. It occurred to me, however, that I haven’t spent time on what an LP shouldn’t ask. Today I’d like to address that head on.

Three Pillars of LP Investing:

Asset Specific Posts:

Tariffs and pricing control: why GPs control less than you think

There are levels to phrasing a question which I discussed here at length. That won’t be the topic for today, but I just want to note that you could be asking the right question, but by phrasing it the wrong way you won’t get the full benefits of the due diligence feedback you’re seeking.

Alright, let’s dive in - what are the 6 things you should not ask a GP?

1) References

This is likely the most common mistake. A GP (whether you like it not) will not put you in touch with someone who’s sitting in a bad deal, and to their credit there’s always two sides to a story. What’s even worse is that ~half the LPs who are currently sitting in challenging investments don’t even realize that, and speaking to them would be extremely misguiding.

All to often, the LP will speak to another LP (who might be clueless about investing themselves) and use that conversation as validation to invest. This is a common trap, and the uncomfortable truth about investing is that you need to build up the confidence in your own investment abilities so that you don’t need to depend on others.

To close - speaking to others is great, but the LP you’re speaking with:

shouldn’t be personally biased (sometimes the referral you’re speaking to has a personal bias for you to invest, whether that be saving the deal, helping the sponsor, or perhaps even monetary compensation,

shouldn’t be “hand picked” by the GP

should know what they’re doing when it comes to investing … otherwise you’re simply doing yourself a disservice.