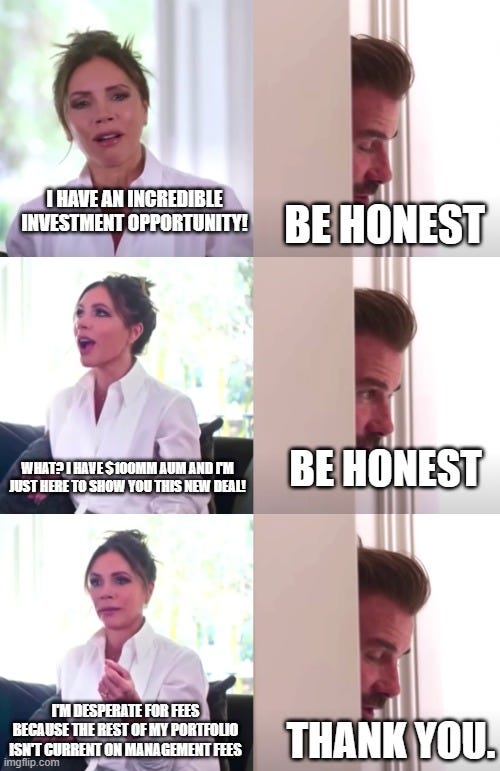

Should struggling GPs be raising money?

On the ethics of raising capital while facing distress

Welcome back and happy Friday!

Here's an intricate topic - GPs raising money on new deals while their existing investments struggle.

LPs get (understandably) upset when they’re stuck in a troubled deal, and the same GP is out raising fresh capital for a new project - smiling on webinars, posting updates, and acting like everything is fine. They have a right to be frustrated. It’s painful to watch your investment falter, and even worse when it seems like the GP has moved on.

But there’s another side to this as well, to be fair. Being a GP is a business, one that heavily relies on fees and acquisitions.

Sometimes deals underperform or fail altogether. Surely we can all agree that just because a GP had a single challenge doesn’t mean they should shut down their platform and get another job, right?

In other words, capital calls (and distress) happen - and they’re not all created equal.

Today, I’d like to address this intricate topic from an independent lens in an effort to address both GPs and LPs.

Announcements (article continued below):

Latest article: Tariffs and pricing control: why GPs control less than you think - which aspects of a real estate deal are truly up to the GP?

NYC LP Event Next Thursday, May 1st:

I still haven’t announced this publicly and we’re at 40/50 registrations currently. If you’d like to come please register here.

You can expect a nice mix of allocators, family offices, and retail LPs in attendance. If you’re interested in sponsoring the event, please reach out.

LPs on GP-LP Match have now gotten 100+ deals for free and the platform is at 1,600+ verified LPs. If you’re an LP or GP join here in under a minute. Pretty cool milestone recently!