Guaranteed red flag

Why "guaranteed" typically means the opposite

Last premium post: The Refinance Assumption Trap

Last free post: LP Investing Digest #23 & Full Article Digest

If you just joined: I write twice per week and you’ll receive those emails as I post them. One article is always premium (such as this one), while the other is a free weekly digest on LP topics that might be helpful to you. If you’d like to upgrade to premium (which includes access to full archive of my articles), you can do so here:

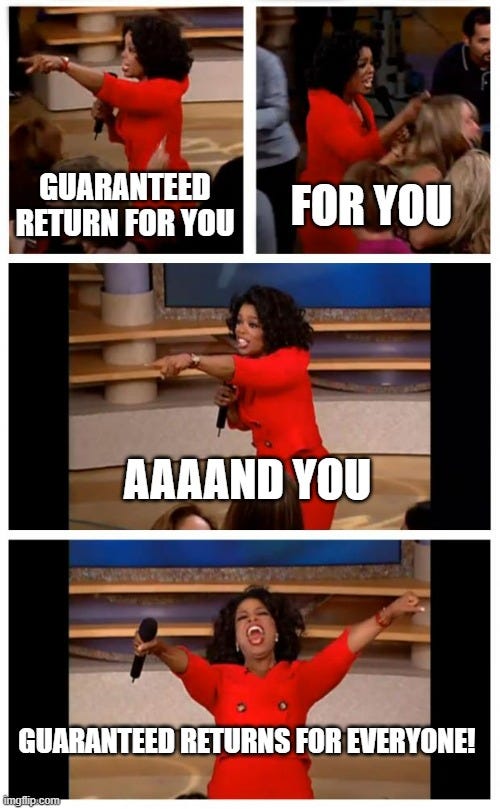

Guaranteed red flag

Welcome back! 👋

It’s not uncommon to see investment opportunities use the word “guaranteed.”

Sometimes, the word is used over a phone conversation but other times it is put directly into the marketing package that is shown to limited partners. I had strong opinions on the matter when I first saw this, but thought it was rare in the industry and didn’t feel that it needed to be addressed.

As I’ve continued on in this business, I've come to realize that the frequency of “guaranteed” use is much higher than I expected. I have also realized that:

It is being used by fairly large syndicators (who should certainly know better) and

Some LPs don’t realize why the term is deceptive and invest thinking the GP is being honest

Today, I would like to address the issue and explain through several examples/screenshots why it is such a problem to present the deal in this manner (and an even larger problem to invest in a deal based on this assumption).

Let’s dive in: