6 Lessons on the Perils of Quick Advice

How getting quick advice before investing can deeply misguide you

Last premium post: What to know about K1s before investing

Last free post: LP Investing Digest #36 & Full Article Index By Topic

LP Cohort: 1 spot remaining for July - you can respond to this email if it’s of interest. Review 4 separate memos together with me and other LPs to learn how to vet LP investments.

Podcast Guests: if you have lessons to share anonymously after a successful or an unsuccessful LP investment, please respond to this email. Previous podcast episodes are here.

If you just joined: I write 2x / week and you’ll receive those emails as I post them. One article is premium (such as this one), while the other is a free digest of LP topics that might be helpful to you. If you’d like to upgrade to premium (which includes access to the full archive of 70+ articles), you can do so below.

You can always reach me at aleksey@hey.com & follow my free posts on LinkedIn & Twitter/X.

6 Lessons on the Perils of Quick Advice

Welcome back, and happy 4th of July! I came to the US at 11 and I’m so thankful to be in the US writing to you today.

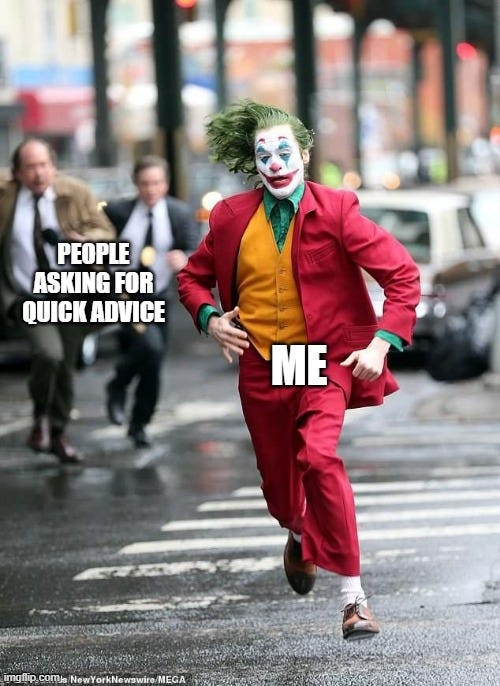

I get a a ton of inbound questions through direct messages similar to the following:

“Hey is a 50/50 split market?”

“Isn’t charging a 3% acquisition fee ridiculous?”

“Are 5 exited deals with a 15% IRR a strong track record?”

I initially took the time to answer these questions, but today I’ll explain why I’ve changed my mind (and think you should too) through 6 case studies.

If you’re an LP, this will illustrate the complexity of investment decisions and pin point areas where you have to be particularly careful to mitigate losing your savings.

If you’re a GP, I hope this article will touch on what LPs might be sensitive to and thereby improve how you communicate your investment thesis.

Let’s dive in: