LP Digest #71

Fiduciary duty conflicts, return of capital, STNL and warehouses

Last premium post: Anti-stock marketing tactics - the private vs. public mirage

Last free posts: LP Investing Digest & Full Article Index (all 120+ published articles organized by topic)

These free weekly LP Digests are sponsored by GrowIt (article continued below):

Dozens of GPs that I know have saved time and money by using GrowIt for their legal and compliance needs on real estate deals. To learn more, you can book a meeting directly with the CEO.

Why Choose GrowIt?

Quick: you’ll be ready to raise in just 10 days (forget 4-6 week setups).

Affordable: $2,500 upfront, and you only pay the remainder if you close.

Seamless: we’ll take the legal and compliance work off your hands, period - entity formation, legal docs (operating agreement, subscription agreement, risk factors, Form D filing, blue sky filings), and investor onboarding.

Both the original post, the quoted tweet, and some of the comments herein are an interesting look inside what can happen when a single GP is on both sides of a transaction … while LPs don’t necessarily understand that.

I’m definitely seeing more of this - see here for the most common tactics during distress.

Sometimes getting your capital back is all you can ask for (and in some cases you should actually be thrilled to get it back) - that’s why the return of capital clause is so important in the event of downside, more at:

An important note on single tenant deals - deeper dive on the topic here

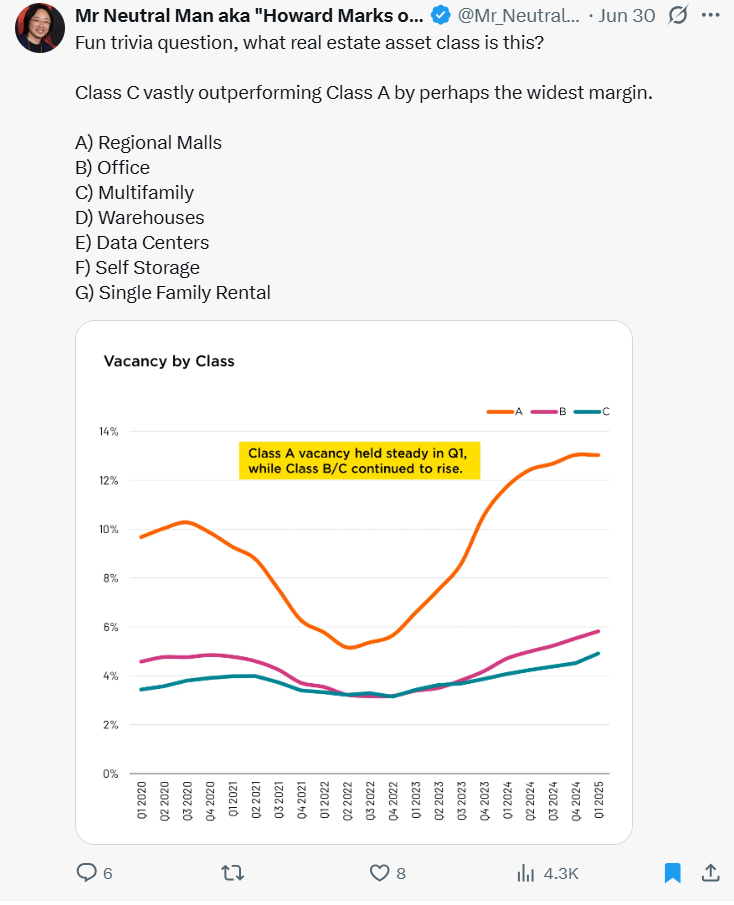

Answer was D - warehouses

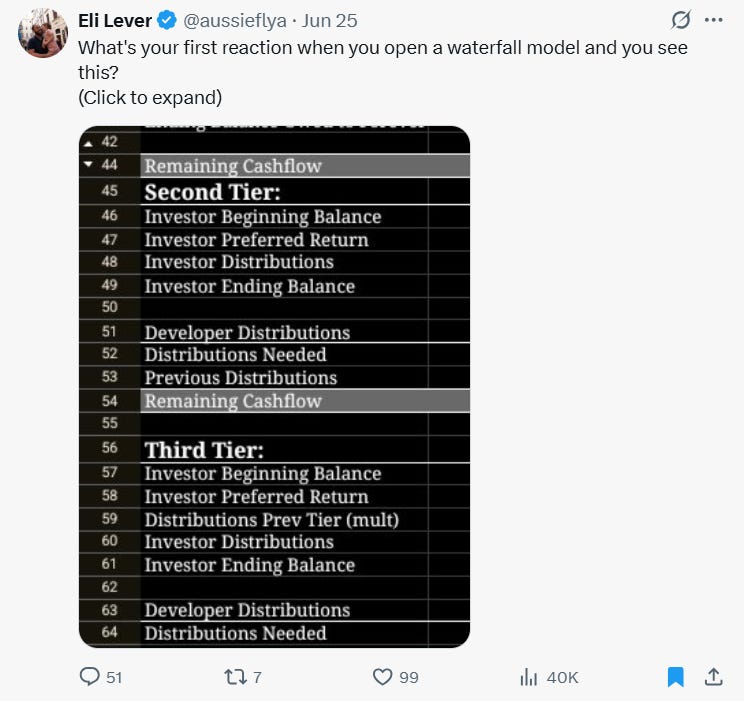

Right or wrong I think things like these are overly complicated and there are usually ways to solve for the same goal - more here

It’s Friday… you know the drill :) Enjoy the weekend!

When you’re ready, I could help you in 3 ways - simply reply to this email if one is of interest:

Limited Partners:

GP-LP Match - a simple way for you to get more deal-flow that matches your precise LP parameters. You can join here in under a minute.

Potential positions - you’re considering investing and need an independent opinion

Existing positions - there’s a lack of communication, you’re concerned about fraud, or perhaps you got a capital call request and you’re not sure how to proceed. I have also helped LPs with a “post-mortem” analysis on deals that didn’t work out - it’s important to learn these lessons as opposed to just blaming the GP.

LP Course - review 4 separate memos in 4 weeks together with me and other LPs to learn how to find good LP investments.

LP Topics Seminar - an ongoing biweekly 1 hour meeting with other LPs where we’ll go over investment decks, capital calls, distressed situations, and modeling. This is meant to provide a deeper look into existing LP investments. Please reply to this email if you’re interested.

LP Community - free 2,800+ member LP Investor community on Twitter

Find GPs in unique asset classes/geographies on my monthly intro post (see LinkedIn’s post as well for more)

General Partners:

Deck review - I’ll look over your marketing materials from the perspective of an LP and provide slide by slide commentary to improve your pitch

Investment review - I’ll provide independent feedback on an opportunity you’re pursuing

Capital call advisory - you suspect that you’ll need to make a capital call, but aren’t sure how to proceed or communicate the message.

Other - anything from waterfall/fee advisory to disagreements between co-GPs on the proper path given a set of circumstances

General Consulting: modeling, strategic advisory, underwriting training, etc.

If you’d like to speak on the phone, you can reach me at aleksey@gplpmatch.com.