Third LP Investment Pillar: Property

Valuation and Business Plan

We recently discussed the first two pillars of the three LP (Limited Partner) investing pillars and today we’ll discuss the last - Property.

Execution - track record and counterparty risk

Read the article here, preferably before continuing.

Alignment of Interests - coinvest, waterfall, and fees

Read the article here, preferably before continuing.

Property - valuation and business plan

As I mentioned in prior articles, the pillars are in the order that I believe you should vet a transaction. It might surprise you that the property is the last thing you look at when analyzing a deck for a commercial estate investment, but this reflects the fact that you’re not just investing in a property - you’re investing in a property through a GP. This is a change you shouldn’t take lightly, since you have close to zero control after wiring your money.

You’re not just investing in a property - you’re investing in a property through a GP.

The reason why the Property pillar is important, is that you might vet the first two pillars correctly but the investment will “stumble” due to the Property pillar.

In other words, you could find a GP that has great Execution capability (Pillar #1) and they passed all of your vetting from the perspective of Alignment of Interests (Pillar #2). Then, you decide to invest in the deal, only to find out that the valuation and/or the business plan was too lofty from the get-go. Unfortunately, I have seen this happen.

Let’s not forget that both income and the investment’s value is tied to the property itself, and although a GP can (and should) influence the trajectory of the investment opportunity, you are (at the end of the day) investing in a building.

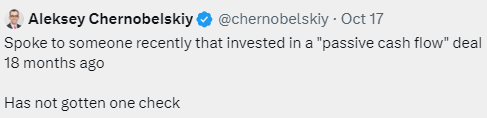

After sharing the tweet below (true story, and unfortunately there are many), I made a meme. In the context of our topic for today - don’t forget to understand and value the property itself (the cash flow generating engine).

The below is a list of things to consider from the perspective of property valuation. For the sake of example, I will use a multifamily property in the writing below.. but of course similar (or slightly varied but equally important) questions apply throughout all asset classes.

Valuation - in other words, is the property actually worth what the GP is paying for it? A few specific things to look out for:

Price:

Take a look at the comps provided. If the property the GP is buying is the best (i.e. cheapest) comp in terms of rent and/or price per square foot, chances are you need to look a lot deeper: