LP Digest #74

Vertical integration, GP mistakes, emerging managers, and more

Last premium post: A deep dive on GP-LP Match data - what we’ve seen from 216 deals in terms of capital allocation patterns, LP demand, and return/structure trends with a downloadable PDF!

Last free posts: LP Investing Digest & Full Article Index (all 120+ published articles organized by topic)

These free weekly LP Digests are sponsored by GrowIt (article continued below):

Dozens of GPs that I know have saved time and money by using GrowIt for their legal and compliance needs on real estate deals. To learn more, you can book a meeting directly with the CEO.

Why Choose GrowIt?

Quick: you’ll be ready to raise in just 10 days (forget 4-6 week setups).

Affordable: $2,500 upfront, and you only pay the remainder if you close.

Seamless: we’ll take the legal and compliance work off your hands, period - entity formation, legal docs (operating agreement, subscription agreement, risk factors, Form D filing, blue sky filings), and investor onboarding.

I think this isn’t talked about enough - I was speaking with an allocator this week and he (verbatim) said “If a GP can’t give a real answer to the largest mistake they’ve had and it was a real mistake, I’m out”

Perhaps this deserves it’s own article, it’s understandably an intricate topic - but my point for now is twofold: (1) sophisticated LPs want to know how GPs react to challenges, and (2) giving a weak answer to this is not only similar to saying your weakness is working too hard in an interview but also makes you miss a huge opportunity to form a relationship and show the “human” part of investing.

I haven’t gotten a chance to write on this more deeply, but will likely do so soon. The short version is that while vertical integration makes a ton of sense for many firms, I think LPs (and GPs) over glorify the concept … many times at the expense of their own returns

This was sort of a joke, but the truth is that I speak to so many people on both sides who think the grass is greener on the other side. If you’re on the side of being an LP thinking about being a GP, I’d read can you teach me to be a GP

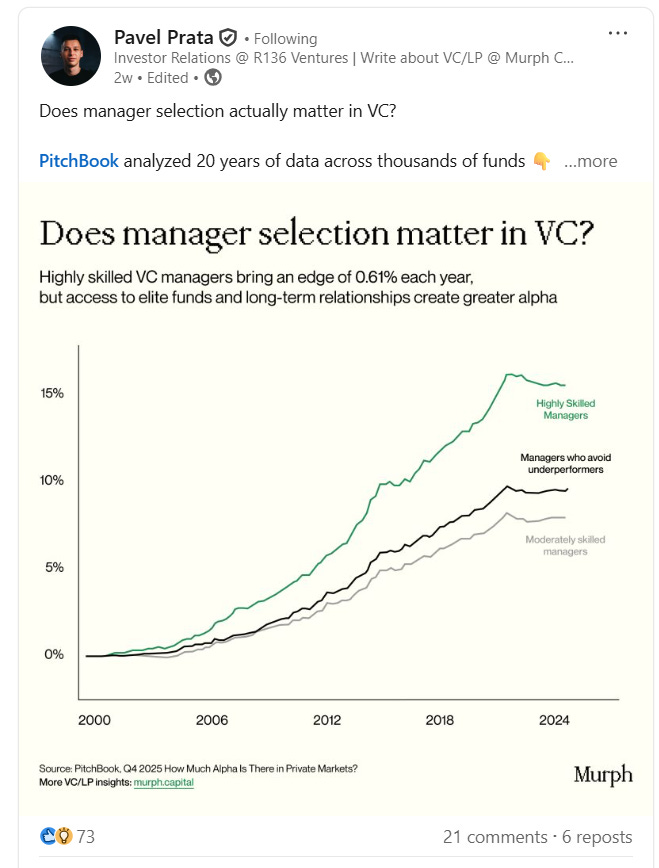

An interesting study, I also previously wrote on selecting emerging managers in the real estate space

We’ve been busy over at GP-LP Match, if you’re a GP who didn’t previously register (one common reason being not doing 506c deals) this would be the time - LPs will be able to search for very precise parameters in a few days and your firm will show up on this list. Register here in 2 minutes.

When you’re ready, I could help you in 2 ways - my email is aleksey@gplpmatch.com:

Limited Partners:

GP-LP Match - a simple (and free) way for you to get more deal-flow that matches your precise LP parameters. Join here in under a minute.

Potential/existing LP positions - advisory work on LP investments

LP Education - self paced recordings to learn more about LP investments

LP Community - free 2,800+ member LP Investor community on Twitter

Find GPs in unique asset classes/geographies on my monthly intro post (see LinkedIn’s post as well for more)

General Partners:

GP-LP Match - a simple (and free) way for you to reach LPs. You can join here in under a minute.

Deck review - I’ll look over your marketing materials from the perspective of an LP and provide slide by slide commentary to improve your pitch and how your terms compare to market